AI-Powered

B-Book Technology

Install our custom MT5 plugin and let AI automatically optimize A-Book and B-Book execution in real time, trade by trade, 24/5.

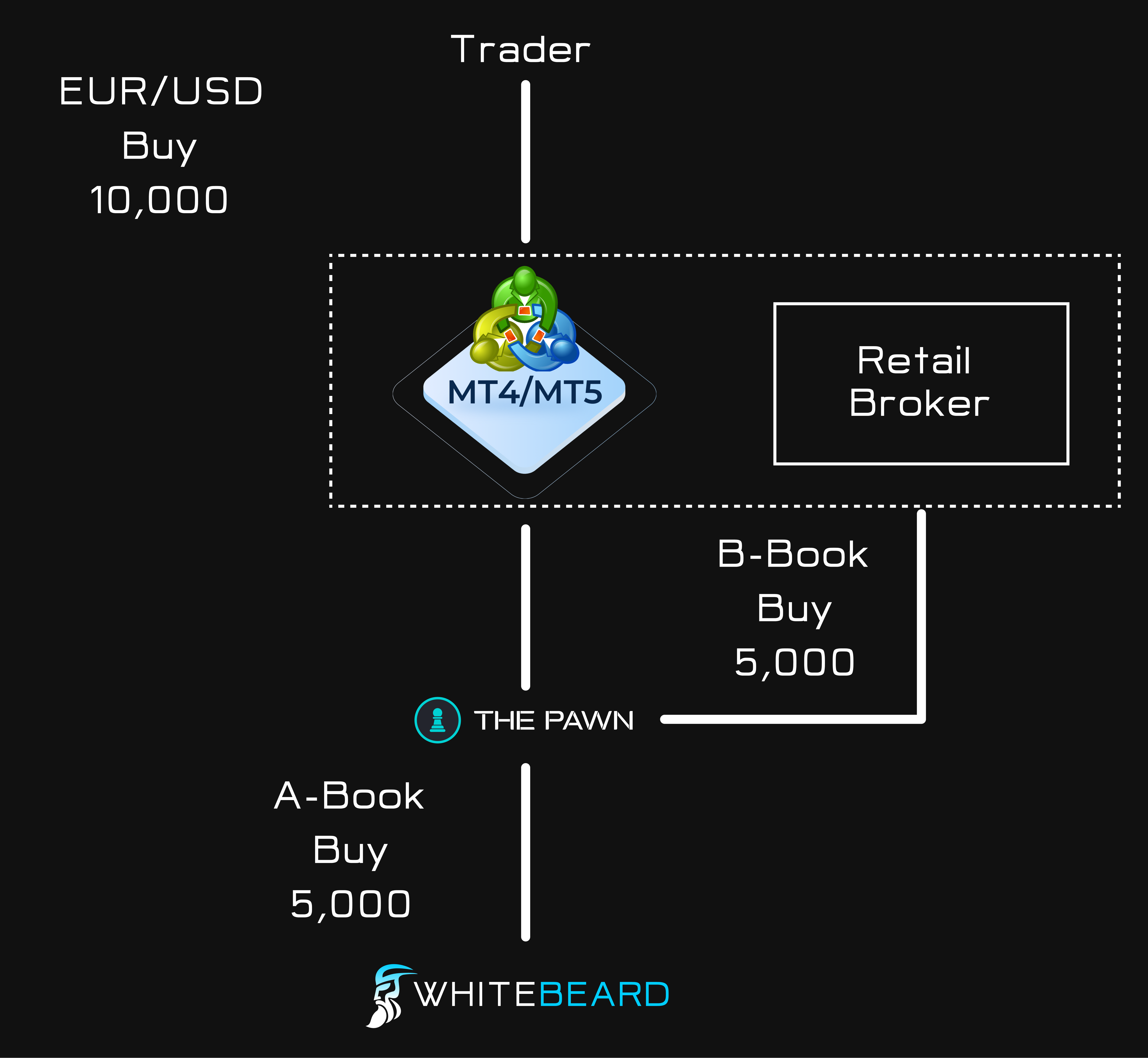

Every order executed on your MT5 server is seamlessly routed to the Pawn, our AI-driven risk management system. In real time, the Pawn intelligently determines whether to internalize the trade (B-Book) or hedge externally (A-Book), executing these decisions automatically on behalf of your firm with precision and efficiency.

Unlike traditional risk management approaches, The Pawn employs a neural network trained on a very small learning window that continuously relearns and forgets. This adaptability allows it to dynamically adjust exposure in real time, enabling firms to automate intelligent risk decisions quickly based on current market conditions.

Traditional risk management often comes at the expense of profitability, but not with the Pawn. Designed to safeguard your firm's capital, the Pawn intelligently optimizes your B-Book by aligning it with its market predictions. Depending on your order flow, this advanced AI-driven approach can significantly enhance profitability while maintaining robust risk controls.

In a zero-sum game, it's rare for a single technology to benefit both counterparties, but the Pawn does exactly that. By intelligently managing risk, optimizing the profitability-to-risk ratio, and enhancing execution efficiency, the Pawn not only strengthens firms' risk management and profitability but also unlocks order flow for liquidity providers, delivering unparalleled value to both sides of the trade.

Brokerage and proprietary trading firms spend years building profitability, only to risk it all in a single bad year. Wall Street investors prioritize stability over short-term gains, and firms with volatile returns face lower valuations. Deploying the Pawn for risk management improves consistency and predictability, increasing firms' appeal to institutional investors and boosting valuations.

Survivorship bias leads brokers to classify traders as A-Book winners or B-Book losers. But in a world of algorithms, indicators, and market shocks, even “bad” traders can land a winning trade. A single unexpected win from a group of B-Booked clients can erase profits and cause prolonged drawdowns. Pawn eliminates outdated risk assumptions, relying on real-time market data and mathematical optimization to make smarter risk decisions.

At the core of WhiteBeard innovation is the Pawn, a proprietary AI driven risk management technology that redefines how FX/CFD brokers handle exposure. The Pawn leverages digital signal processing, artificial intelligence, advanced mathematics, and data science to dynamically optimize risk decisions in real time.

Traditional risk management relies on historical data and static models, often leading firms to categorize clients as A Book or B Book candidates based on past performance. However, in today's algorithm driven markets, past trends are unreliable indicators of future risk. The Pawn takes a completely data driven approach, dynamically calculating the optimal theoretical exposure a firm should maintain across major currencies every millisecond.

The FX/CFD market is inherently zero sum; every winner has a corresponding loser. While spreads and fees give firms an initial edge, the Pawn takes profitability further by automating risk decisions, stabilizing returns, and increasing the odds of preserving capital during volatile market events.

For firms looking to enhance risk adjusted returns, retain more revenue, and attract higher investor valuations, the Pawn is a game changer. By leveraging cutting edge AI, WhiteBeard enables FX/CFD brokers to move beyond outdated manual risk management and embrace an intelligent, data driven future.

FX/CFD brokers using MetaTrader 5 can seamlessly integrate the Pawn plugin into their trading infrastructure with a plug-and-play solution. The setup is straightforward and requires no changes to existing liquidity providers, order flow, or client configurations.

Simply install the MT5 plugin, connect to the Pawn, and let AI-driven optimization dynamically manage A-Book and B-Book execution in real time, trade by trade, 24/5.

Banks, exchanges, hedge funds, proprietary trading firms, and larger institutional clients can connect directly to the Pawn via custom gateway. Contact us to set up your custom dedicated connection.